A Detailed Guide on Private Limited Company Registration in India

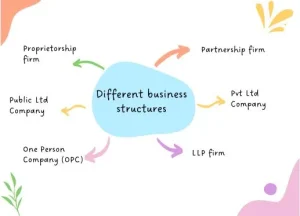

So you have got a great business idea and want to turn it into reality, but are still unsure about the right business structure for your business? Here let us have a look at various business structures in India and their features. This guide will help you have a better understanding of Business Models in India and their defining characteristics

Choosing Your Business Armor: A Look at Structures

Imagine your business as a valiant knight. In India, you get to choose its armour – the legal structure that defines its operation and liability. Here’s a brief overview on some of the common business strategies

- Proprietorship Firm: Great for small businesses, but the owner(s) have unlimited liability, meaning their personal assets are on the line if the business incurs debt. This model might be apt for businesses which are focused on the personal skill of an individual. For instance like a professional practice of a doctor or an advocate, This structure offers a great deal of operational flexibility but might not be suitable for business ideas that aims at scaling up and operating on a large scale.

- Partnership Firm: This is a structure very similar to a sole proprietorship on many levels. Here a group of people come together to undertake a business activity. The terms between them are written down as an agreement in a partnership deed. The liability of partners is unlimited like in a proprietorship. This format is widely adopted by professionals like advocates, Chartered Accountants, etc for professional practice

- One Person Company (OPC): A single-owner company with limited liability, ideal for solopreneurs seeking a formal structure. This is a relatively new concept and was introduced in the Companies Act 2013. By adopting this structure the business can enjoy the benefits of both a sole proprietorship as well as a private limited company

- Limited Liability Partnership (LLP): This is a hybrid business model, combining the likes of a partnership firm and a private limited company. The LLP is a business format under the supervision of MCA and is governed by the provisions of the LLP Act 2008. An LLP offers the benefits of limited liability for partners and more flexibility in profit-sharing agreements. It is ideal for small to mid-size businesses, that have many partners.

- Private Limited Company (PLC): The focus of this guide! PLCs offer limited liability, can raise capital from investors, and are perfect for businesses aiming for growth. It is “THE” business structure favoured by new-age businessmen and Start-Ups. It is a very comprehensive structure that presents great scope for expansion and raising of third-party funds. Also, a PLC is viewed as a credible entity since it comes under the strict surveillance of the Ministry of Corporate Affairs

- Public Limited Company: Similar to a PLC it can raise funds through public offerings of shares. This we are not discussing in detail, since it is not a business structure that can be adopted for a new business. However, if you still want to know more drop in an mail any time at info@clearbiz.in , so that we can get back to you

Why Structure Matters?

Choosing the right structure is like picking the perfect armour for your business. A PLC offers the best protection for your personal assets and opens doors for future growth by attracting investors. This is structured by most of the businesses due to various features it Offers

Features of a Private Limited Company Registration In India

Now let us have a look at some interesting characteristics of a private limited company in India

- Separate Legal Entity: A PLC is a separate legal entity for all purposes of law. It can own assets, obtain loans, and enter into contracts in its name. It can sue as well as be sued in its name. This feature helps in separating the shareholders who are the true owners of a company from its management

- Limited Liability: your liability is limited to the amount you’ve invested in the company. This means your assets, like your house or car, are shielded from business debts. Even if the business incurs losses and has business obligations over the net assets, the owners do not become personally liable.

- No of Members: Only a minimum of 2 people are required to start a private limited company registration in India

- Minimum Capital: The Companies Act 2013 does not impose any minimum capital requirement for incorporating a PLC. So you can float your dream venture for capital as low as Rs 1000

- Perpetual Succession: As the axiom goes, Men May Come and Men May Go, but the company goes on forever. A PLC being an artificial person is not affected by a normal human life span. So your company can outlive you and carry forward your business legacy for equality

Ready to Register? Here’s Your Step-by-Step Guide

Thankfully, India has embraced the digital age! Registering your PLC can be done entirely online through the MCA (Ministry of Corporate Affairs) portal. Here’s what you need to do:

- Name: The most important step in Company formation is arriving at a suitable name. Your business name will contribute greatly to your business’s brand image. The entire identity is built around the name. Also, MCA is likely to approve Unique names on comparison to generic names , since name have to comply by provisions of the Companies Act 2013.

- Digital Signature Certificate (DSC): All directors and subscribers (owners) need a DSC. In most cases, it’s a USB token just like a normal Pen drive. It’s an encrypted device that is used for affixing e-signatures

- Director Identification Number (DIN): This unique number identifies each company director. If you plan to be a director, you need to get a DIN from MCA

- MCA Portal Registration: Head to the MCA portal and register your company using the SPICe+ form. This streamlined form lets you get several things done at once. Spice forms can be applied only with the attestation of a practising professional.

- Submission of E MOA & E AOA: As part of the comprehensive forms, E copies of MOA & AOA of the company are to be submitted

- Examination of Application: Once all the Forms are duly submitted, it is examined by CRC -MCA and a query if any is raised. If all documents are in order,they approve the application and allot CIN ( Company Identification Number)

- Certificate of Incorporation: Once your application is approved, you’ll receive the Certificate of Incorporation, the official birth certificate of your PLC!

It is always advisable to seek professional help for the application filing. Since this requires attestation from a CA/CS/Advocate, get in touch with a reliable professional. Also, this would help in understanding case specific issues you might have to look out for.

Documents You’ll Need:

Let’s have a look at the documents you need to keep handy for PLC Registration

- Identity and address proof for directors and subscribers (passport, Aadhaar card, etc.)

- Proof of registered office address (utility bill)

- Rental agreement for RO

- No Objection Certificate from Owner of the premises

- Digital Signature Certificates of Proposed Director/Members

Simplify the Journey with Clearbiz

While the online process is user-friendly, navigating legalities can be daunting. Consider partnering with Clearbiz, a company registration expert. They can handle the paperwork, ensure everything is compliant, and get your PLC registered smoothly.

Checklist for Success:

- Gather all required documents.:

- Obtain DSCs and DINs (if applicable).

- Choose a unique and compliant company name.

- Fill out the SPICe+ form carefully.

- Submit the application and pay the fees.

- Relax and wait for your Certificate of Incorporation!

Cost Considerations:

The cost of registration varies depending on factors like authorized share capital and government fees. Also, the stamp duty for PLC registration would depend on the Stamp Act of the State in which the Company has its Registered Office

It’s generally affordable, and Clearbiz can provide you with an estimated cost upfront.!

Benefits of Being Registered:

- Limited Liability: Your personal assets are protected if the company faces debts.

- Enhanced Credibility: A registered company projects a professional image and attracts investors.

- Easier Access to Funds: Banks and lenders are more likely to provide loans to registered companies.expand_more

- Separate Legal Entity: The company becomes a distinct legal entity, allowing for better financial management.

With this guide and Clearbiz by your side, registering your PLC in India will be a smooth ride. Get ready to unleash your business potential and watch your venture soar! For more details visit us at www.clearbiz.in or connect us through Linkedin.

Frequently Asked Questions (FAQs)

1. How much does it cost to register a PLC?

The cost can vary depending on factors like government fees and Stamp Duty levied by the state in which the Registered Office is. The higher the authorized capital higher the government fees and stamp The good news is, Clearbiz can provide you with a free estimate to give you a clear picture of the costs involved.

2. How long will it take to register my PLC?

Under normal circumstances, registering a PLC typically takes around 10 working days. However, it’s always best to factor in some buffer time for any unforeseen delays, since the process is entirely dependent on MCA Website , which occasionally faces downtimes

3. Can I register my PLC from anywhere in India?

Of course Yes ! The benefit of the Online process is that you can register your company from the comfort of your couch, anywhere in India. No more geographical limitations.

4. Is the entire registration process online?

Yes! The process is entirely online

5. How can I check if a company is already registered?

The Ministry of Company Affairs (MCA) maintains a public portal where you can easily search and verify the registration status of any company in India. Each company registered in India are allotted a unique CIN (Company Identification Number). Any person can search for Company Details from MCA Website using Company Name or CIN . This search reveals basic company details as well as details of the present Board of Directors. Moreover there is also a paid serch available wherein certain public documents of the PLC like Balance Sheet , Annual Report etc can be viewed.