Understanding the Kerala Trade License: The Shops& Establishment Act registration in Keral

What is a Trade License in Kerala?

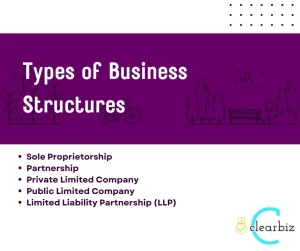

Trade license is a common layman’s term for registering your business under the Shops& Establishment Act, Kerala. The provisions of this act are equally applicable to all organizations undertaking any kind of business / commercial transactions in Kerala. Also, it is worth noting that in case you have multiple offices in the state, spread across multiple districts, then the license must be taken for each office premise

Types of Trade Licenses in Kerala

For the purpose of classifying an Entity, the act proposes three classes of business: Small, Medium & Big. In case the entity employs less than 5 persons, it’s classified as Small, 6-19 people it’s medium and greater than 20 persons it’s a big enterprise.

Validity of Trade Licenses in Kerala

Once your business gets registered, it has to renew the license every year. Also, any changes to the details furnished at the time of registration must be made and intimated to the authority within 30 Days

Documents Required for Trade License Application in Kerala

To apply for a trade license in Kerala, you’ll need the following documents:

- Identity proof: Aadhaar card, PAN card, passport

- Address proof: Ration card, electricity bill, voter ID

- Property documents: Sale deed, lease agreement, rent agreement

- No Objection Certificate (NOC): If renting the premises, nOC from the original owner

- Other relevant documents: Depending on the nature of your business

- Declaration on no of employees

Step-by-Step Guide to Obtaining a Trade License in Kerala

Securing a trade license in Kerala is a straightforward process:

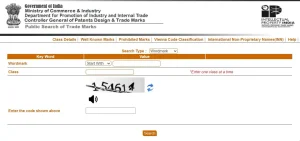

- Online Application: Visit the official portal to file your application online

- Filling the Application Form: Provide accurate details about your business and owner.

- Submitting Required Documents: Upload the necessary documents as specified.

- Payment of Fees: Pay the prescribed application and license fees.

- License Issuance: Upon verification, the authorities will issue the trade license.

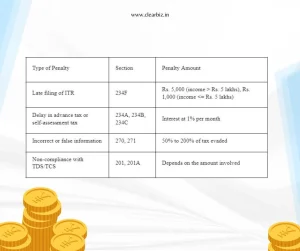

Penalties for Operating Without a Trade License in Kerala

Operating without a valid trade license in Kerala is a serious offence. Penalties can include:

- Fine up to ₹ 5,000.

- Additional ₹ 250 per day post-conviction.

- ₹ 250 per day after notice for breach discontinuation. This may be restricted to Rs 10,000

FAQs

1.How to take a trade license in Kerala?

Obtaining a registration under Kerala Shops & Establishment Act is an online procedure. Visit the portal to, Fillup the details and submit for processing

2.What is local trade license?

It is the common name for Reg under Shop and Establishment Act, it is required by all organisations undertaking commercial transactions

3.What are the benefits of having a trade license in Kerala

More than a benefit, it is a legal requirement to get registered

4.How long does it take to get a trade license in Kerala?

It can be obtained in a week.

5.How do I renew my trade license in Kerala?

Its similar to the registration process. Contact ClearBiz for more business services. For more help mail us at info@clearbiz.in