Form 10-IEA: Choosing the Old Tax Regime | A Guide to Filling & Submitting Online

Form 10-IEA allows individuals or HUFs to continue with the old tax regime for the financial year 2023-2024. The form is not required to be filed by persons filing ITR 1 or ITR 2. They can choose the Old regime of taxation on the ITR itself. Proposed by the Central Board of Direct Taxes vide Notification No. 43/2023, Form 10 IEA offers taxpayers a choice to be taxed under the erstwhile old regime. The default tax regime from FY 2023-24 will be the new tax regime as per Budget 2023. To opt for the old tax regime, taxpayers must submit Form 10-IEA before they file their income tax returns. Let’s go deeper into Form 10-IEA and its key aspects.

Description of Form 10-IEA:

The new tax regime became the default option following Budget 2023. Taxpayers seeking to retain the old tax regime need to file Form 10 IEA to make their choice. By completing Form 10-IEA, individuals can exercise their right to choose between the new and old tax regimes.

Purpose of Filing Form 10-IEA:

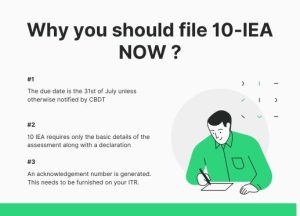

Here’s why submitting Form 10IEA matters:

- Individuals with professional/business income must submit Form 10-IEA before the due date for filing a return of income. The due date is the 31st of July unless otherwise notified by CBDT

- Form 10 IEA requires only the basic details of the assessment along with a declaration (Forming part of the form itself).

- Once the Form is successfully filed an acknowledgement number is generated. This needs to be furnished on your ITR

Changes in Form-10IEA:

Previously, taxpayers needed to file Form 10-IE to opt for the new tax regime until FY 2022–23. Beginning FY 2023–24, the new regime became the default tax regime. Taxpayers not declaring their choice automatically fall under the new regime. This change benefits individuals without business income, simplifying the preference selection process during tax return filing.

Submission Deadline for Form 10-IEA:

To ensure compliance with tax regulations and allow smooth processing of your information by authorities, submit Form 10-IEA online before the income tax return deadline (usually July 31st). A unique acknowledgement number received post-submission helps track and reference your form in future communications when filing an ITR.

Verification of Form 10-IEA:

Before online submission of Form 10-IEA, validate it thoroughly using an electronic verification code or digital signature. Only a successfully verified form will be taken on record by CPC –Income Tax

Discontinuation of Form 10-IE:

With the introduction of Form 10-IEA, previously used by taxpayers to opt for the new regime, is now discontinued due to default selection of the new regime as per Budget 2023 reforms. This change enables taxpayers interested in reverting to the old regime to do so by filing Form 10-IEA.

For more information on the process of filing Form 10-IEA, please email us at info@clearbiz.in or visit www.clearbiz.in