Limited Liability Partnership Registration Procedure In India

Will you like to join an Indian partnership firm as a partner? You have to register with a lot of needs.

This blog will fully elaborate on the process of Partnership Firm Registration along with documents, fees, advantages, and the process involved.

How does Partnership Registration work?

Partnership is one of the most common forms of business seen in India. It is very similar in terms of operations with a sole proprietary concern. It can be understood as a group of people coming along to start a business, with a common goal. Now since this is an arrangement between 2 or more persons, it always better to have an agreement. This partnership agreement will lay down the roles and responsibilities of each partner, the profit sharing ratios, conditions for admitting new partners, circumstances when the partnership shall come to an end, etc.The agreement may be oral or written , but for better legal standing a written partnership agreement is always preferred.

Partnerships can be classified into 2 types -Registered and Unregistered

- Registered partnership firm- It is registered under the provisions of the Indian Partnership Act, 1932 and all these provisions apply to them.

- Non-registered partnership firm – The provisions of the Indian Partnership Act, 1932 do not apply to such firms as they are not registered under the provisions of the Indian Partnership Act, 1932.

However, in 2008, the Ministry of Corporate Affairs introduced a new form of partnership, known as a Limited Liability partnership(LLP). This form of an entity is very similar to a registered partnership but with added protection. LLP come under the strict monitoring of MCA and is bound by the provision of the LLP Act.

A major feature that sets apart an LLP from a regular partnership is that the liability of partners of an LLP is limited unline in a a regular firm

Advantages of Registering an LLP

- Legal recognition: Registration of LLP provides better legal standing. It helps to prove the existence of the firm and the partners which is very important while working with banks, customers, suppliers and so on.

- Credibility in the market: Registered LLP are more credible than unregistered ones.

- Easy to start: An LLP is relatively much easier to start compared to the process of forming a private limited company

- Resolution of disputes: Registration of LLP is one of the common ways to deal with disagreements between the partners. Partnership agreement is a legal document and registered firms can exercise legal remedies in case of partner disputes.

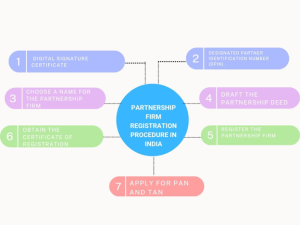

LLP Registration Procedure In India

Step 1: Get a Digital Signature Certificate.

Get a Digital Signature Certificate for all the designated partners. An e-signature that may be used to sign paper online is known as a DSC.

Step 2: Get a Designated Partner Identification Number (DPIN).

As the designated partners acquire DSC, they must also request DPIN and DSC. An LLP requires a minimum of 2 Designated Partners and may have as many partners as required.Each and every DP of the entity must provide his particular identification or DPIN. On the MCA website, members or partners can apply the DPIN for the same.

Step 3: Decide on a partnership firm name.

A firm’s name should be determined by the partners. The LLPs name may not be similar to a company or LLP that already exists. Furthermore, the name may not be contrary to law.

Step 4: Prepare a LLP AGREEMENT

in this regard, the partners must prepare the terms and conditions of the partnership formal agreement in a partnership deed. The deed must include the following:

- The partnership’s name.

- The partners’ names and addresses.

- The business’s nature.

- The profit-sharing ratio.

- The duration of the partnership.

Step 5: Register the LLP FIRM

The registration for partnership is granted through an application submitted to the Ministry of Corporate Affairs The following information should be available in the application:

- Name of the partnership firm

- Names and addresses of the partners

- Nature of the business

Presently the entire process from name reservation for an LLP to incorporation is performed under a single comprehensive form called FiLLiP form under the MCA Portal

Step 6: Get the Certificate of Registration

The LLP is issued with the Certificate of Registration once the Registrar of Companies approves the request.

Conclusion

Starting a LLP firm in India is easy to do, but it depends on particular attention to detail and meeting laws and regulations. Ensuring that you generate and present all documents, correctly will help to ensure a seamless registration process.A valid registration enhances the business’s credibility and growth potential. At Clearbiz, our team is ready to assist you with the required legal forms.

FAQs on Partnership Firm Registration Procedure

- How many days will it take to register an LLP firm in India?

In India, the LLP firm takes 10 to 14 working days.

- How much money is needed to start a partnership firm?

In India, minimum capital is not required to start an LLP by law

- Is GST compulsory for partnerships?

An LLP firm has to register for GST if its annual turnover is more than ₹20 lakhs/40 lakhs in a financial year.

- Is it possible that a partnership is not valid?

Generally, if the partnership agreement is not registered, the court may recognize the partnership agreement as invalid.

- Can an unregistered partnership firm open a bank account?

The banks do open the current account of the unregistered partnership firm